Antique Silver in the Art Market

“Cecil Graham: What is a cynic? Lord Darlington: A man who knows the price of everything, and the value of nothing. Cecil Graham: And a sentimentalist, my dear Darlington, is a man who sees an absurd value in everything and doesn’t know the market price of any single thing.” Oscar Wilde, Lady Windermere’s Fan

INTERESTING NEW ACQUISITIONS

During the art fairs we have participated over the years, we have been often seen some very happy faces. It is not about happiness in general but about the sparkle and joy a dedicated collector has, when s/he sees a new, interesting and beautiful object. Then one starts to talk on the piece, to touch and see it from all sides, to hear on it. This multi-sensory experience with a piece of silver – like with a piece of art in general – is what evokes different feelings in a person who collects that are not easy to express. What is sure is that, at this moment, the desire to possess an object is born. This is what we believe to be a basic driver to acquire a silver object: desire and love for the art, the material and the art object.

Silver can be considered just as a timeless ornamentation of one’s home or a must-have in a collection. Besides the emotional, aesthetic and art historical side, silver has been established in the long-run as a secure investment. To that event, it has an own part in a collectors’ portfolio and agenda. Either a cynic or a sentimentalist, as the quote from Oscar Wilde says, at the moment when the desire is born, a collector who manages to step back a few seconds and think clearly, then s/he starts to consider the value and the price of a silver object.

Since historical silver as part of the design and collectables’ sector is for sure an attractive art category and art investment, and since many collectors consider to buying also silver or are only collecting silver, this article should be considered as a support to those who are collecting, buying or investing in silver or are considering to do so. The desire to possess and live with silver objects is also ours and for this, we would like to share our experience and perspective. More than that, we strive to be your experienced and professional expert who can guide you through the wonderful and very enriching world of historical silver.

On the Art Market

Artworks and art objects are collected, bought and sold for several reasons. These include the sense of aesthetics, the historical conscience, the financial interest and the need to show status.

Two are the general characteristics of what is called “art market”:

- The art market is divided in primary (artists) and secondary (dealers, collectors, agents, auction houses). The primary entails more risks, whereas the secondary entails less risk but eventually higher costs. The possible higher costs are due to the time-period art works stay within dealers, agents and the like. This ensues costs for the storage, insurance and participation in art events like fairs, which affect the final price of objects and artworks. On the other side, an artwork is this way available and on offer for a longer period, than is the case in an auction for instance.

- Art can be a good investment because there are many submarkets, many of which have different returns and risks. One must find thus the right niche for him/her.

Aside the socio-economic approach to art and art objects, most pieces of art are totally unique and have a different value and a different price. Value is a complex concept and depends not only on measurable factors, but also on emotional (e.g. impact of a work on a buyer or collector). The measurable factors of value are: title/attribution, authenticity, rarity, quality, condition, provenance.

The Value of Antique Silver

The criteria for the formation of value in the art market are mostly grounded on the object itself. This rule applies also for the art objects made in silver and helps to form an objective appraisal of an object.

The factors mentioned above include firstly the title or attribution. By this is meant, on the one side the attribution to a maker and a place of production of the object. This results by resolving the marks that are to be found on a piece of historical silver. Gradually after the Middle Ages, the rules of the European silversmiths’ guilds imposed the punching of an object with a distinguished mark for the maker and a fixed mark for the city. Nowadays, there exists a large amount of specialised literature which deals with the marks of makers and the different European cities (and elsewhere) where silver objects were produced. There are in silver as well famous silversmiths, who were recognised as skilful and creative artists during their life time and beyond. These can be traced through their documented marks. For the German silver, one could mention for instance Wenzel Jamnitzer (1508-1585) and Christoph Lindenberger (†1586), two Nuremberg makers active during the late Renaissance.

On the other side, title and attribution are also often connected to the design of an object attributed to a specific architect, designer or even painter – a kind of second-degree attribution. In this case, the attribution is not always obvious on the first place and one must conduct thorough research through archives, graphic works and paintings, to find the original drawing or pattern used. This kind of attribution usually raises the value of an object, since it adds different levels of complexity to the work. Many known pieces made by architects and painters are to be seen in different museums around the world. Helga Matzke European Silver shows also a very beautiful pair of reliefs, whose inspiration are well-known paintings of the seventeenth century.

The issues of maker, production place, and a second-degree attribution bring us to the next factor of authenticity. Authenticity can be again proofed through the existence of marks on the silver piece, the availability of archives and of the used patterns. However, as in the other art sectors, in silver as well, there are quite a lot of fake objects or copies of early pieces in the market. For this reason, one should address to a specialist or become a specialist on its own and keep in a safe place any certificate of authenticity or any record with regards to the silver piece.

Another important factor for the formation of the value of silver is rarity. There are several aspects that add to making a silver object rare, such as destructions through wars, revolutions and accidents but also destruction due to fashion changes. It is well-known that during the ages, people were melting down old pieces of silver they possessed, to make new ones. These new products were conformed to the fashion and style rules and design tendencies of their time. The older an object is, the greater value it has thus, also because it has survived through centuries of wars, proprietor’s changes and other events. Besides, on the issue of rarity, one must not forget that particularly beautiful or important pieces of silver are rare, because a museum or a private collector has acquired them. Thus, the art market is always short of exceptional pieces that belong in public and private collections.

As next comes then the quality of an antique silver piece. Through the different inflation phases in the economic history of the twentieth and twenty-first century and through the great wars of the past century, high-quality silver has maintained its value and price over time. The question is of course: what is high-quality silver? To the quality of a silver art object contribute the existence of the marks, which can be traced in the relevant literature. Then, there is the amount of silver used in the production of an object. Silver is quite smooth when used on its own, thus it has been used in metal alloys to be able to form it better. It is for instance known, that in Great Britain and in France, silver objects contain around 90% silver or more as raw material and the rest is a mixture of necessary metals to produce a piece. The aesthetic quality of a silver object is on its own also complex, but also to be proofed through art historical analysis.

For the German Silver, an object made in Nuremberg or in Augsburg represents most often a high-quality artwork. These two cities of Southern Germany were not only active in silver since early times, but they were also very important for the formation of wide-known makers. The makers of Nuremberg and Augsburg had customers around Europe and the European Royal courts counted to their ordering customers. A very famous case is that of the German-born Catherine the Great of Russia, who had her silver made in the most important silversmith centres of Europe, among those Augsburg.

All the previous factors of the value of historical silver are connected one way or another to the specialists, being them mostly art historians and historians. However, the condition of silver artworks can be also analysed and assessed through natural-scientific methods and thus through other kinds of specialists. With the developments of natural sciences and tools that help to the analysis of artworks as well, the importance of expert’s reports has gained a lot of ground during the twentieth century. Metallurgical analyses play thus an important role in the value of silver, but only if they are seen together with art historical reports. Silver could always be melted down and skilled forgers could often reproduce the metallurgical elements found in silver made in the UK, France or Germany. Thus, in the study of silver, one should base results on a holistic approach. Finally, there is the matter of repairs on silver, which change in a definitive or a subtle way the artwork. Those can be contemporary or older, seen with the naked eye or after close analysis with a loupe. One should approach this issue from case to case, but in general, an object’s condition is much more appreciated with no repairs or no substituted elements.

A last important criterion for the formation of the value of silver is provenance. Provenance may have a distinct impact on the actual and future value of an object. The art world always considered the biography of art works highly relevant to their value. Since at least the eighteenth century, provenance played an important role in European art market centres. Provenance signalled besides two main factors: authenticity and elevated aesthetic quality (e.g. if an art work had been in a prestigious collection or exhibition). Both had a significant influence on the economic value of the silver objects. The biography of an art work was thus closely connected to the art market, which was in the process of creation of international networks mainly in the nineteenth century (through agents, dealers and auction houses).

In this context, catalogue raisonnés and sale catalogues became important and were presented in a professional manner. These were and are listing information about artists, art works and provenance. A renowned, “celebrity provenance” (e.g. Royal house) or a “great collector’s provenance” held and holds potential for an increase in value (see for instance a spectacular sale in the summer 2017 by Sotheby’s).

Provenance can be proved by the existence of specific engravings, like coat of arms and inventory numbers on the object. In addition, written or photographic documentation add a significant and constant value to the provenance history. Historical analysis, biographical elements of the maker, the possibility to find comparable objects, all these are elements that add importance to an overall analysis and hence to the provenance.

During the last years and, especially after the Washington Conference in 1998, collectors and museums pay particular attention on the provenance of pieces during the National-Socialist Era and the Second World War, thus the period 1933-1945. The focus is there on Jewish proprietors who were obliged to sell under duress or who have seen their artworks and collections confiscated just before and during the Second World War. There is a series of online databases on which one can search for a registered object (lost, confiscated, or stolen). Moreover, there exist archives which document the ways certain objects have taken during this era.

Looking for the provenance of the object does not only raise its financial and art historical value, but also is conformed to due diligence rules in the art world as well. On the other side, it is very seldom that objects have a traceable provenance history with written records. Therefore, an art historical and cultural analysis of the art objects are very important to support the context of their creation, and their aesthetic and economic value as well.

Value, Price and the Market for Antique Silver: The Big Picture

Art is beautiful but also demanding in terms of aesthetic feelings, knowledge, ideas, life perspectives and value (monetary and historical). Even though there are a lot of registered prices for silver objects (mostly through auction houses), it is difficult to make predictions on the development of this segment of the art market. The problem lies more generally in the way the global art market is analysed, since there is no specific model or a fixed analysis that can be used (Boll 2011: 12).

Art is an alternative for investing, however it requires a personal engagement on a long-term basis, a constant interaction with the art works and a good idea of the niche market and its objects – in our case, the silver market and history of silver. Especially in periods where all asset prices are high and interest rates low, art is an alternative to invest in, having considered of course all the risks it entails.

Since the beginning of the 1990s, it became widely evident that art is and can be an attractive asset. However, artworks were considered investment goods since the end of the 1970s. Art funds represent a kind of price index, because they document the price and value development of the art objects of a niche market through the purchase price and the return.

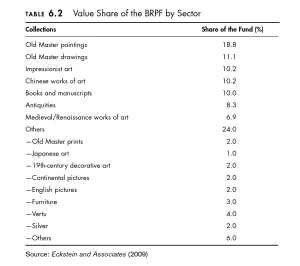

One of the first art funds created in the 1970s was the “British Rail Pension Fund” (BRPF). In 1974, the BRPF invested in art. The focus was especially in fine and decorative art: old Master prints, Japanese prints, English silver, French furniture and other. The BRPF eventually devoted some £40 million ($70 million), or about 3 percent of its holdings at the time to art (s. picture drawn from McAndrew 2010, p. 142). At the beginning of the 1980s, the BRPF sold the art works in a collaboration with the auction house Sotheby’s. This whole decision and investment policy became popular because it was the first very large-scale and systematic attempt to treat art as an investment vehicle.

Thus, a differentiated investment portfolio which includes art obliges the collector: on the one hand to pay attention on the value of the artworks, but also to engage in an active life with those artworks s/he collects. The so-called “blue chips” artworks, those with a guaranteed capital appreciation, are those that are of high-quality and have a constant value. Those are saleable in good and bad times.

Closing Remarks

From all the above, it becomes evident that in investing in silver, one should have the right tools and information to judge. Economical and art historical knowledge and a hands-on experience with the objects play a capital role. Besides having by one’s side the right specialists or art dealers, the collectors and investors themselves became in the twentieth-century even more empowered, through the many possibilities of being and staying informed. One can observe thus, that collectors are more conscious on the quality of silver and more selective in their choices.

Nevertheless, the relation of a person to art is and can be emotional. With the objects of silver, there is moreover a sensory side which cannot be ignored when one wants to acquire them. Most certainly, emotion is not a good advisor for investment, however, art has not only an economical value. Aesthetics, touch and an invitation to think and reflect on emotions, life and history are an essential part of art. All this, a good value of silver and love for the material should be the criteria for acquiring silver objects.

We would be very delighted to accompany you through the rewarding journey of historical silver. Helga Matzke makes no compromises when it goes for the quality and authenticity of objects. These and love for the silver object are our credo and we hope to hear from you and help you build up wonderful historical silver collections!

Selected Bibliography

Boll, Dirk, Kunst ist käuflich: Freie Sicht auf den Markt, Ostfildern: Hatje Cantz, 2011 [2 überarb. Ausgabe]

Gramlich, Johannes, ‚Kunst und Materie. Dinghistorische Perspektiven auf den internationalen Kunstmarkt im 20. Jahrhundert’, In: Zeithistorische Forschungen/Studies in Contemporary History, Online-Ausgabe, 13 (2016), H. 3, URL: http://www.zeithistorische-forschungen.de/3-2016/id=5392, Druckausgabe: S. 404-425. (access: 27.09.2017)

Gramlich, Johannes, ‘Reflections on Provenance Research: Values – Politics – Art Markets’, In: Journal for Art Market Studies 2 (2017), https://fokum-jams.org/index.php/jams/article/view/15 (access: 27.09.2017).

Howard, Jeremy R., “Art Market” In: Encyclopædia Britannica: https://www.britannica.com/topic/art-market (access: 28.09.2017).

McAndrew, Claire (ed.), Fine Art and High Finance: Expert Advice on the Economics of Ownership, New York: Bloomberg Press, 2010.

Völcker, Wolfram (ed.), Was kostet Kunst? Ein Handbuch für Sammler, Galeristen, Händler und Künstler, Ostfildern: Hatje Cantz, 2011.

Whyte, Alasdair, Art fund backgrounder: Three key examples of art funds, In: PrivateArtInvestor, http://www.privateartinvestor.com/art-finance/art-fund-backgrounder-three-key-examples-of-art-funds/ (access: 2.10.2017)

AXA ART (ed.), Collecting in the Digital Age: International Collectors Survey, AXA ART: Cologne, 2014.

The bull market is everything: Asset prices are high across the board. Is it time to worry? In The Economist, 7.10.2017 (access: 19.10.2017).